With the widespread growth of proprietary trading firms (Prop Firms) and the increasing search interest in platforms such as FTMO, traders now have multiple options to prove their skills and gain access to funded trading accounts.

At the same time, newer models like Trading Battles have emerged as a more flexible and lower-pressure alternative to traditional prop firm challenges.

In this article, we provide a comprehensive comparison between Trading Battles and Prop Firm Challenges to help you choose the path that best suits your trading stage and goals.

What Are Prop Firm Challenges?

Prop firm challenges, such as those offered by FTMO, are paid evaluation programs designed to assess a trader’s ability to generate profits under strict conditions, which typically include:

- Achieving a specific profit target (usually between 8% and 10%)

- Adhering to maximum daily and overall drawdown limits

- Trading within a defined time period

- Strict compliance with risk management rules

Advantages

- Access to large trading capital

- A well-known and widely recognized model

- Opportunity to build a professional trading track record

Disadvantages

- Relatively high participation fees

- High psychological pressure that may impact performance

- High failure rates, even among skilled traders

- Focus on passing the challenge rather than long-term skill development

What Are Trading Battles?

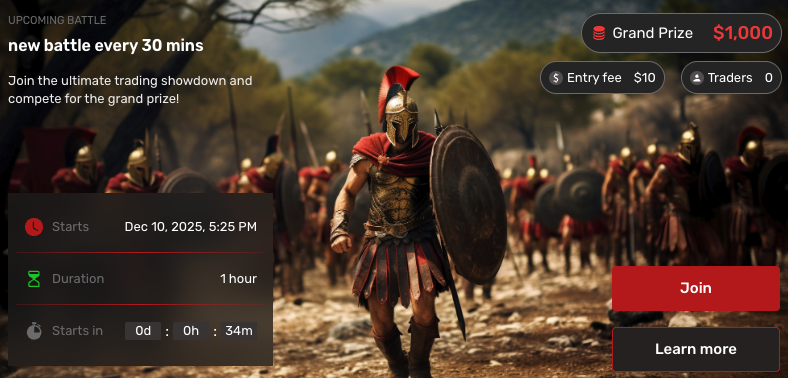

Trading Battles are competitive trading environments where participants trade within a fixed time frame and are evaluated based on relative performance compared to other traders, rather than achieving a fixed profit target.

Advantages

- Lower psychological pressure compared to prop firm challenges

- Greater focus on real performance and consistency

- Competitive and motivating environment that supports growth

- Suitable for beginner and intermediate traders

- Low or even free entry costs on some platforms

Disadvantages

- Smaller rewards or funding compared to some prop firms

- Not all competitions lead directly to a funded account

- Success depends on relative ranking among participants

Direct Comparison: Trading Battles vs Prop Firm Challenges

| Factor | Trading Battles | Prop Firm Challenges |

|---|---|---|

| Entry Cost | Low or free | Relatively high |

| Stress Level | Moderate | High |

| Rule Flexibility | High | Limited and strict |

| Main Objective | Skill development and competition | Passing an evaluation |

| Suitable For | Beginners – Intermediate | Professional traders |

| Funding Size | Limited or gradual | Large upon success |

Which Option Is Right for You?

The decision depends on your current trading stage:

- If you are still learning or building a stable strategy, Trading Battles are an ideal choice

- If you are confident in your performance and seeking large capital, Prop Firm Challenges are the better option

- If you have experienced repeated failures in prop firm challenges, Trading Battles may offer a better environment to rebuild confidence and discipline

Conclusion

There is no universally “better” option—only the option that is most suitable for you at this moment.

Prop firm challenges offer real opportunities to access significant trading capital, but they require strong discipline and the ability to handle intense psychological pressure.

Trading Battles, on the other hand, provide a more flexible and educational environment and represent a smart step before transitioning into funded trading accounts.

At Tradeiators, we believe that successful traders focus on developing their skills first, then pursue capital with confidence and consistency.